how will taxes change in 2021

As of April 2021 most states have. Quarterly estimated taxes for individuals are still due April 15 2021 too.

Tax Season 2022 What You Need To Know And Looking Ahead To 2023 Ramseysolutions Com

Here are the minimum income levels for the top tax brackets for each filing status in 2022.

. As noted above the top tax bracket remains at 37. 1 day agoChanges for tax year 2021 included. For taxpayers who claim the standard deduction they can still claim cash contributions up to 300.

But most of those tax law changes expired at the end of 2021. Whether youre a small business owner or just do a gig on the side its important to keep up with the latest tax laws before you. 2021 Federal Income Tax Brackets and Rates.

Take a look at the topics. 8 New Tax Laws Changes For 2021 Taxes. Certain filers may qualify for the enhanced child tax credit.

The earned income tax credit has increased with these new tax changes but keep in mind some of these changes may only apply to the 2021 tax year. 539901 up from 523601 in 2021 Head of Household. There are seven federal tax brackets for tax year 2022 the same as for 2021.

Theres a good chance the new deadline applies to your state taxes. Big tax breaks were enacted for the 2021 tax year. The other six tax brackets set by the IRS are.

Another year of grappling with coronavirus has led to significant tax law changes for the 2021 season. This year Americans will need to make adjustments when it comes to how much theyll get in tax credits. In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Tables 1.

Standard Deduction for 2021 Tax Year. IR-2021-219 November 10 2021 The Internal Revenue Service today announced the tax year 2022 annual inflation adjustments for more than 60 tax provisions including the. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024.

But when it comes to your 2021 income taxes. The difference is due to inflation during the 12-month period from September 2019 to. Department of Revenue has released the 2021 Tax Law Changes publication which summarizes the recent legislative changes to the States Revenue laws.

11 Must-know changes for 2021 taxes. Although the tax rates didnt change the income tax brackets for 2021 are slightly wider than for 2020. Well cover the top tax law changes for 2021 and outline whats different plus why it could matter for you.

The percentage and the child care expense thresholds changed so you could get a credit up to 50 of 8000 4000 in child care. Tax changes will affect how you file your taxes in 2023. As a result the child tax credit child and dependent care.

New for the tax year 2021 if youre married filing jointly. Terms and conditions may vary and are subject to change.

Tax Credits Could Replace Senior Freeze Rebates New Jersey Monitor

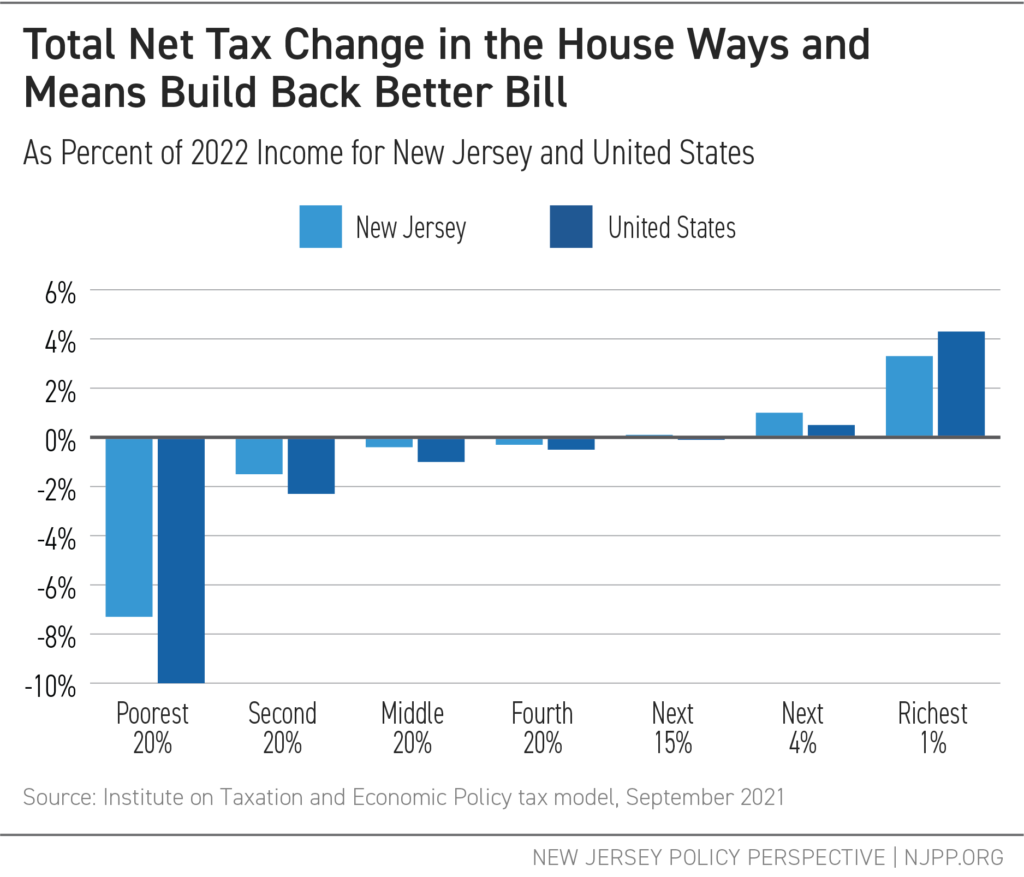

Build Back Better Legislation Makes The Tax Code Fairer But Only If Salt Cap Stays In Place New Jersey Policy Perspective

What Is The Child Tax Credit Tax Policy Center

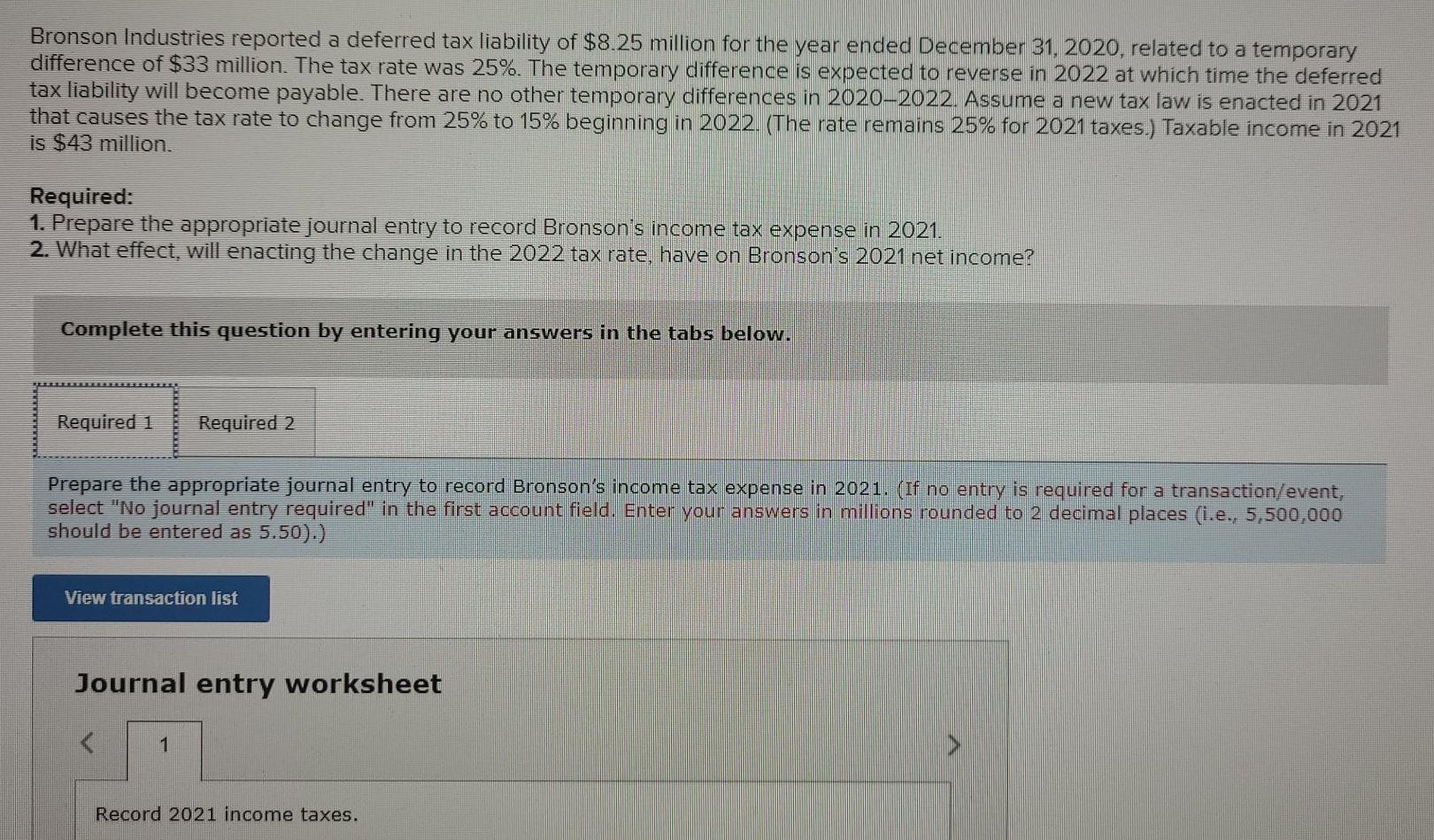

Solved Bronson Industries Reported A Deferred Tax Liability Chegg Com

Average Nj Property Tax Bill Rose Again In 2020 Nj Spotlight News

National Tax Day April 18 2022

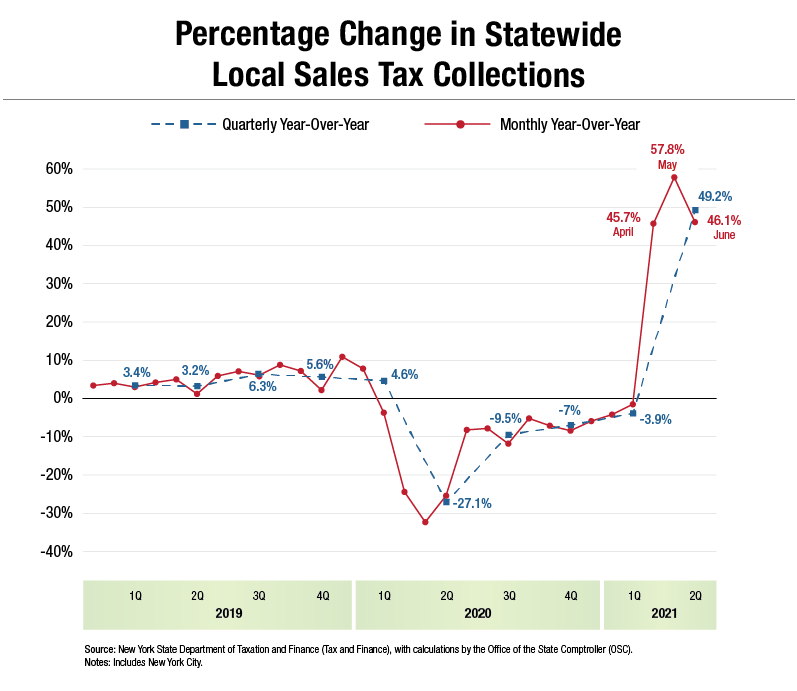

Dinapoli Local Sales Taxes Jump 49 2 Percent In Second Quarter Office Of The New York State Comptroller

Inkwiry Federal Income Tax Brackets

/cloudfront-us-east-1.images.arcpublishing.com/gray/T7J2XB6MOFDURPGLNMA7SFIMMM.jpg)

Proposed Property Tax Change Would Impact 1 In 4 Briargate Homeowners

Trump And Biden Tax Policies Cato At Liberty Blog

Dearborn Taxes To Drop For Schools After Change In State Funding Press And Guide

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Tax Tip Got Married Here Are Some Tax Ramifications To Consider And Actions To Take Now Tas

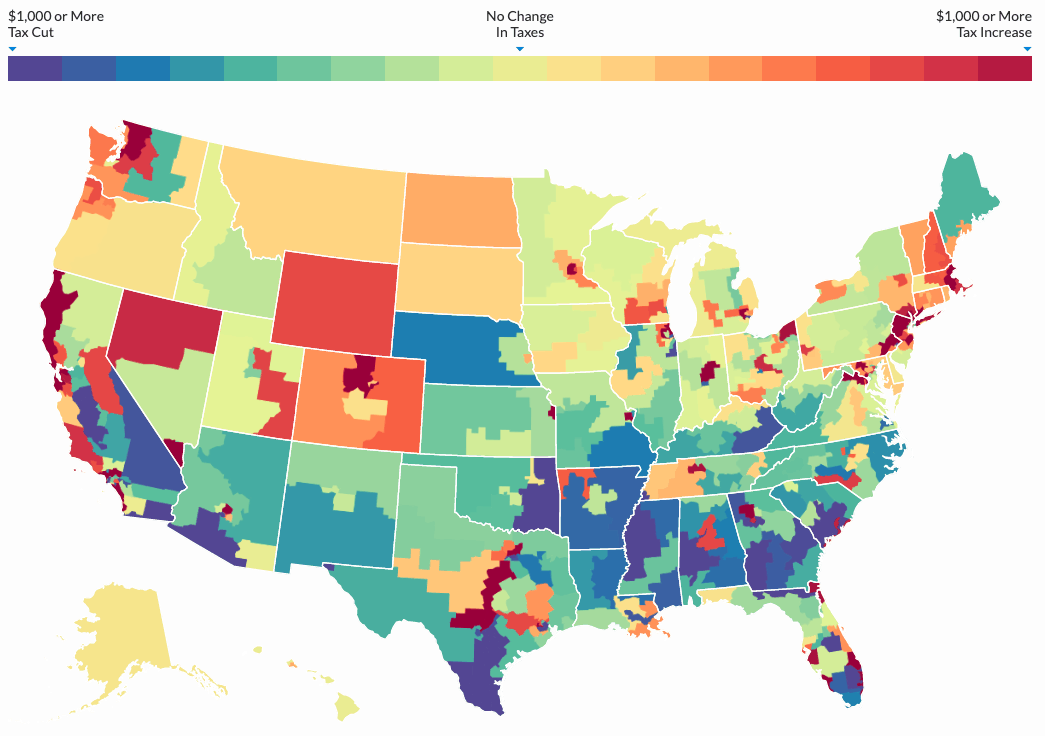

How Trump S Tax Reform Plan Will Change Things 2021 2022

2021 Federal Tax Deadlines For Your Small Business

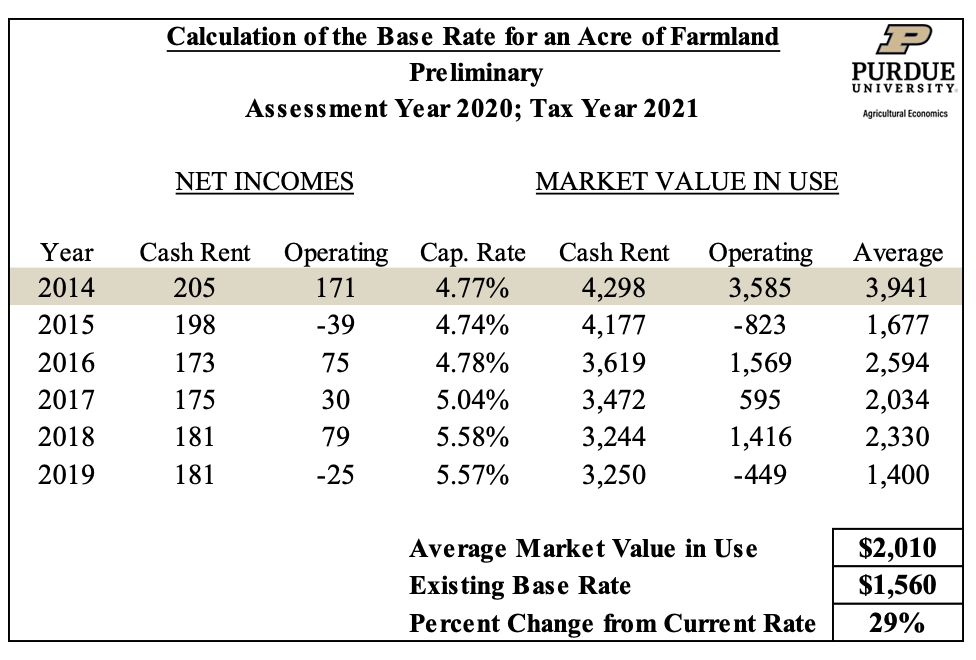

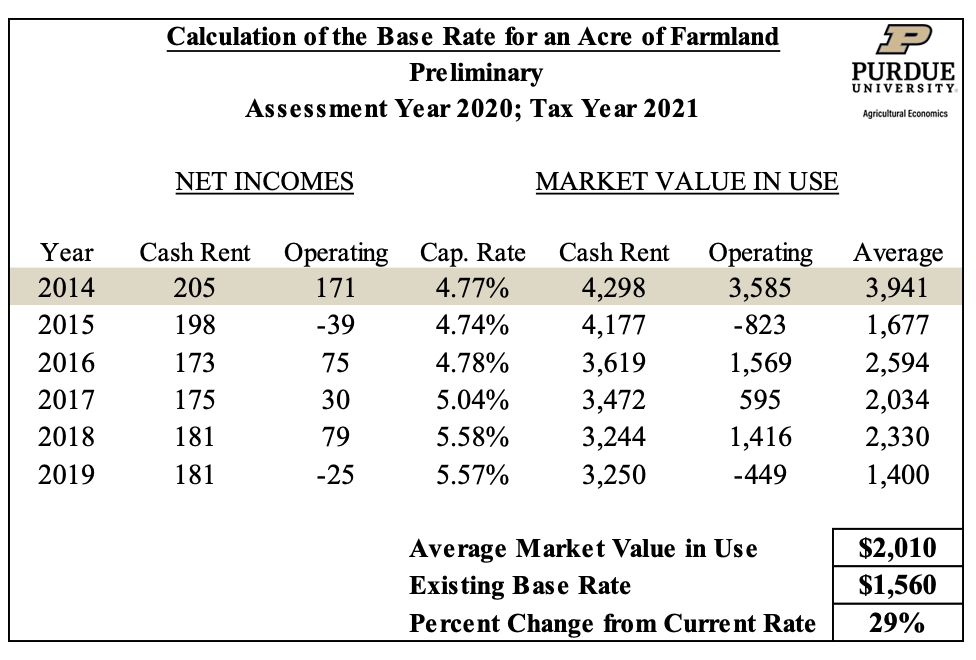

Farmland Assessments Tax Bills Purdue Agricultural Economics

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others